child tax credit december 2021 how much

How much money you could be getting from child tax credit and stimulus payments. The expanded Child Tax Credit CTC for 2021 was a part of the American Rescue Plan Act ARPA signed into law by President Biden to get pandemic cash assistance to more families.

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

The final payment for the child tax credit will be made on 15 December.

. This expanded child credit is in effect for 2021 and 2022 and it expires at the end of 2025. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. Parents with children from ages 6-17 are eligible for up to 3000 per child or 250 per.

First your child cant be older than 18 by the end of December 2021. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. How Next Years Credit Could Be Different.

Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250 per child. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The 2021 child tax credit for newborns will be capped at 3600 total per eligible child going down from there as your income goes up.

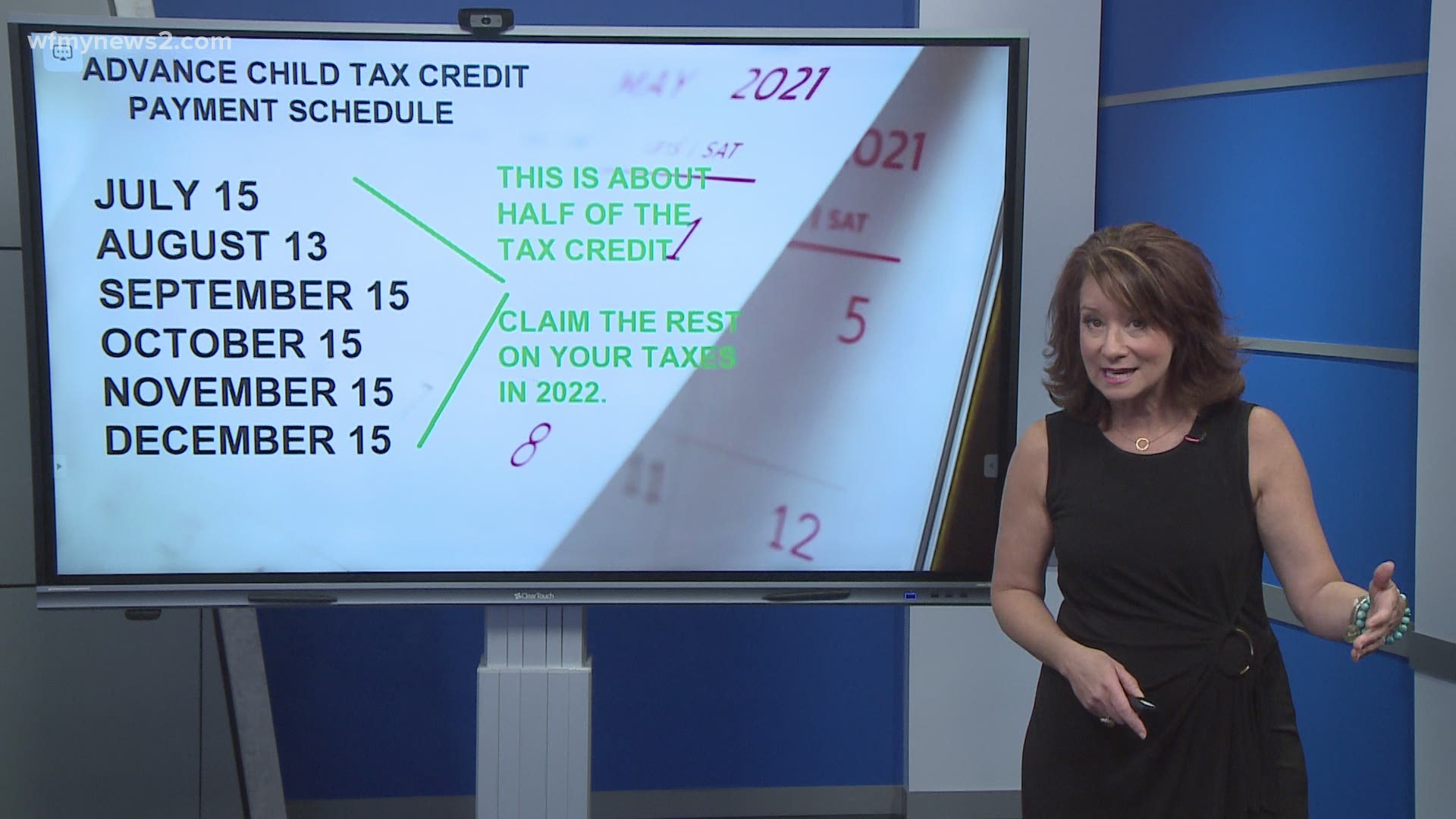

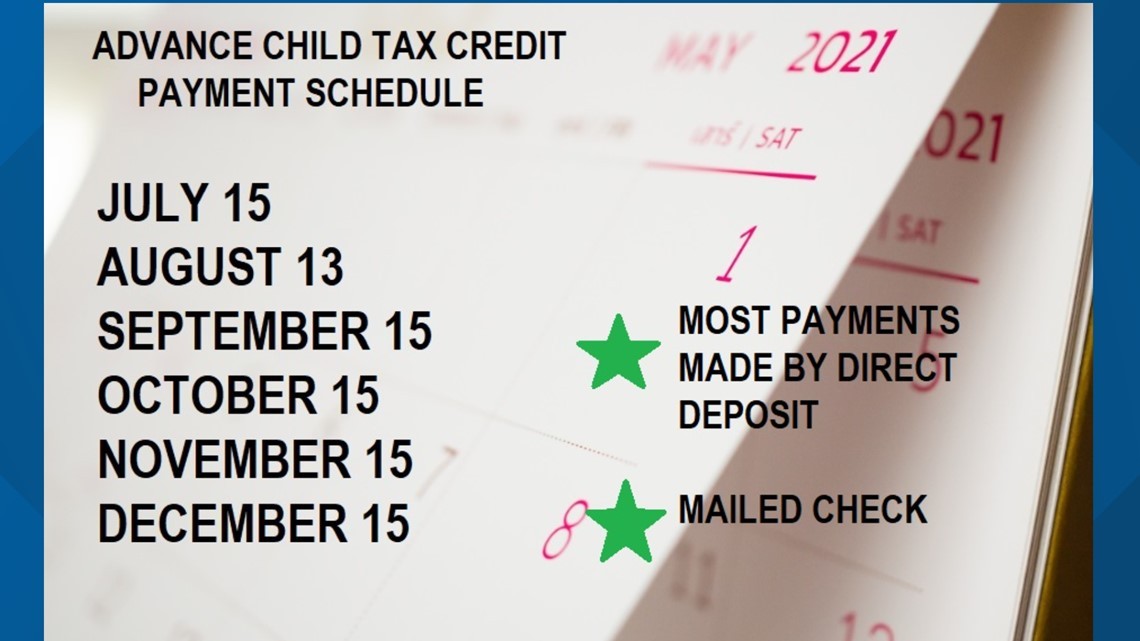

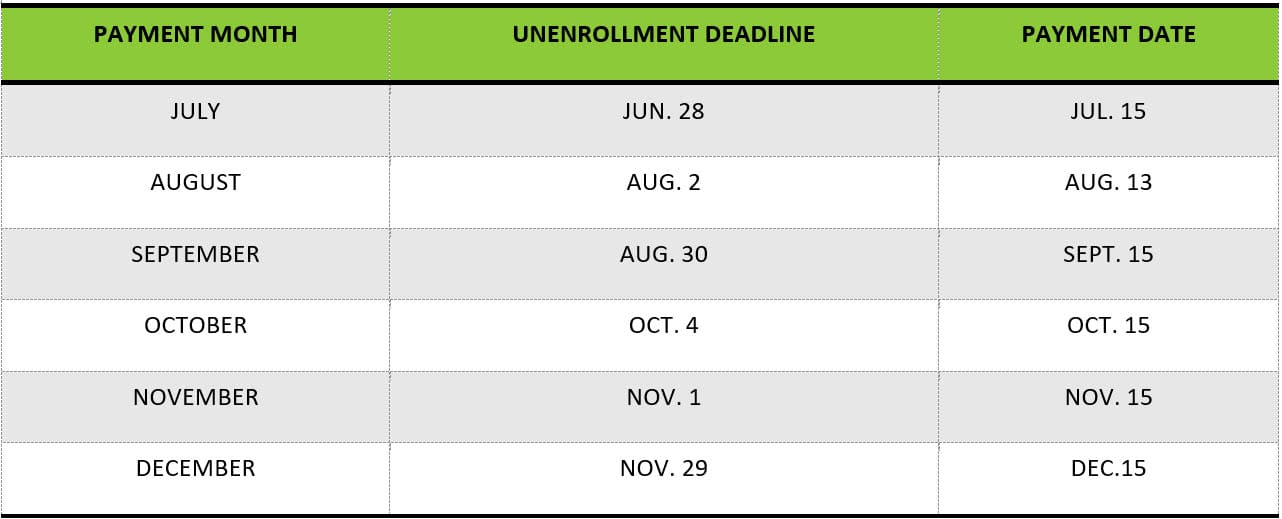

Last March Congress added a second. How much is the December Child Tax Credit. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

How much do you get back in taxes for a child 2022. That means the total advance payment of 4800 9600 x 50. Taxpayers who have an extension for filing their 2021 state tax returns should receive their.

The 2021 Child Tax Credit. In Rhode Island distribution of checks for the child tax rebate began on October 3. To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and.

How much money will families have received from Child Tax Credit by December 2021. The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to.

Parents with children under age 6 are eligible for up to 3600 per child or 300 per month. Qualifying children can include a birth child stepchild adopted child or foster child placed by a court. A childs age determines the amount.

For 2021 eligible parents or guardians. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Enhanced child tax credit.

Child Tax Credit 2022. Up to 3600 per child or up to 1800 per child if you. Beginning in July 2021 payments are to be.

The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families. The IRS allowed qualified individuals to receive 50 of their estimated child tax credit payment in 2021. It helped roughly 60 million children and helped cut child.

Do you get more money back on taxes. The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for.

However if the IRS paid you too much in monthly payments last year ie more than the child tax credit youre entitled to claim for 2021 you might have to pay back some of. Under the new law the credit is fully refundable meaning families who owe little or no federal tax will get a check for the full amount.

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Child Tax Credit December 2021 How To Track Your Payment Marca

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

Why Might The December Child Tax Credit Payment Be Bigger Than The Others As Usa

December S Child Tax Credit Payment Is The Last One Unless Congress Acts Cnnpolitics

Child Tax Credit Monthly Advance Payments To Start Arriving July 15

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

Fact Sheet Advance Child Tax Credit

All You Need To Know About The New Child Tax Credit Change

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab

What Is The Child Tax Credit And How Much Of It Is Refundable

The Child Tax Credit The White House

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Child Tax Credit Advanced Payments Information Bc T

Gauging The Impact Of The Expanded Child Tax Credit S Expiration